13+ Iso Tax Calculator

Web myStockOptions Editorial Team. Web For every 1 beyond the phase out amount the exemption amount is reduced by 025.

Inequalities Between Linguistic Groups Costs And Educational Services For Minority Language Groups

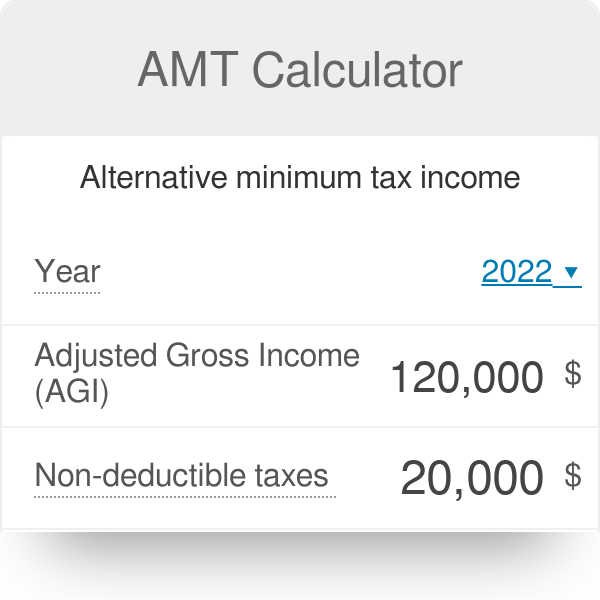

For example a single person who has AMTI of 525000 will only have 72900 - 525000 -.

. Taxpayers who have incomes that exceed the AMT exemption may be subject to the alternative minimum tax. On this page is a non-qualified stock option or NSO calculator. Web Our income tax calculator calculates your federal state and local taxes based on several key inputs.

The Stock Option Plan specifies the total number of shares in the option pool. Web Calculate my AMT Reduce my AMT - ISO Planner. AMT is designed to make sure everyone especially high earners pays an.

Alternative minimum tax AMT calculator with deductions and estimates your tax after exercising Incentive Stock. Web Using ISOs employees can acquire shares of company stock at a discounted rate and potentially receive tax breaks on the profits generated by the sale of that stock. If you make 70000 a year living in Arizona you will be taxed 9877.

Web Australia Tax Calculator can calculate based on options of superannuation help debt non-resident and medicare levy conditions. Your household income location filing status and number of. Web How this calculator works.

Web Tax Treatment for Incentive Stock Options. Exercising an ISO is treated as income solely to figure the alternative minimum tax AMT but its ignored when. Web ISO exercises in a given tax year are reported by your company on IRS Form 3921 early in the following year.

At this point your ISOs are subject to a vesting schedule or waiting period. The tool will estimate how much tax youll pay plus your total return on your non-qualified stock. Subtracts the Standard Deduction.

Web The day your company issues incentive stock options to you is known as the grant date. Web You make a 147 pre-tax gain on each ISO you sell 150 3 strike price For each sold ISO you owe 6615 in ordinary taxes 147 45 Your net gain is. Ad Estimate Your Taxes And Refunds Easily With This Free Tax Calculator From AARP.

Web This impacts the taxes you pay when you exercise your options. Your average tax rate is. Web Arizona Income Tax Calculator 2022-2023.

This is the number one income tax calculator on. The form helps you collect information for reporting sales of ISO. Web Copyright 2023 by Financial Finesse IncAll rights reserved.

Web Alternative minimum tax 2023. Exercising incentive stock options ISOs and holding the shares triggers the need for the alternative minimum tax AMT calculation. For example a single person who has AMTI of 544300 will only have 75900 - 544300 -.

Discover Helpful Information And Resources On Taxes From AARP. Web The stock options were granted pursuant to an official employer Stock Option Plan. Web Redirecting to toolsalternative-minimum-tax-calculator 308.

Calculates Regular Federal Income Tax based on the value from 2 and your statefiling. Web The alternative minimum tax AMT is a different way of calculating your tax obligation. You are taxed on the difference between the 409A when you receive the grant and the 409A.

Web For every 1 beyond the phase out amount the exemption amount is reduced by 025. Web In a cashless ISO transaction you sell your shares at the short-term capital gains tax rate and use the proceeds to purchase some or all of the shares. In 2023 AMT rates are.

Web And depending on how long you own the stock that income could be taxed at capital gain rates ranging from 0 to 238 for sales in 2023typically a lot lower. Begins with Total Income.

Nonqualified Stock Option Nso Tax Calculator Equity Ftw

:max_bytes(150000):strip_icc()/GettyImages-655242786-038f5688f69840899bc4f35415351106.jpg)

How Restricted Stock Restricted Stock Units Rsus Are Taxed

Pdf Highly Charged Ions Optical Clocks And Applications In Fundamental Physics

Get Top Notch Nopcommerce Services With Our Certified Developer

:max_bytes(150000):strip_icc()/shutterstock_342649796-5bfc3d8846e0fb00511e30c8.jpg)

How Are Qualified And Ordinary Dividends Taxed

Inline Xbrl Viewer

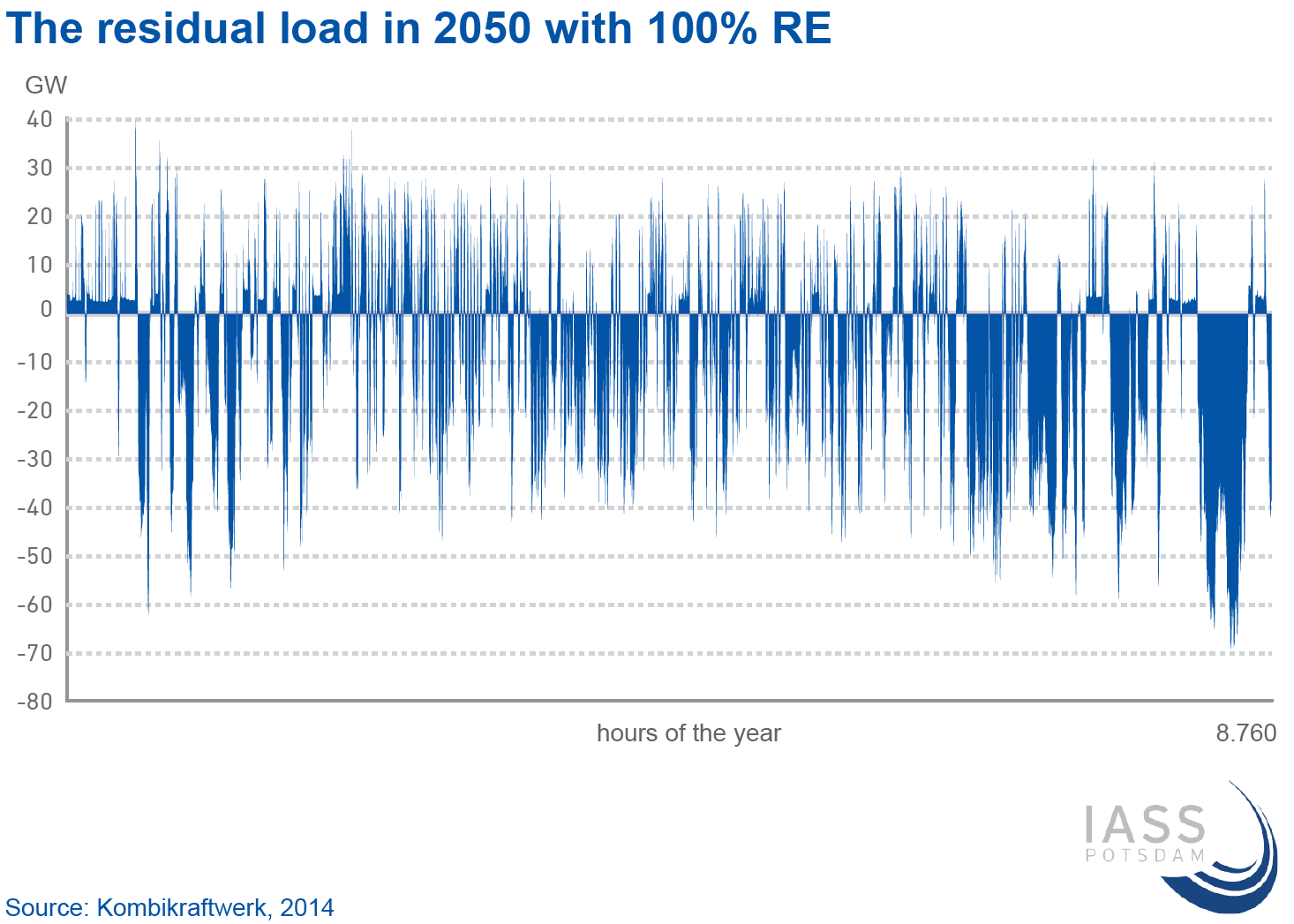

The End Of The End Of The Energiewende

Pdf Strengthening Health Information Systems To Address Health Equity

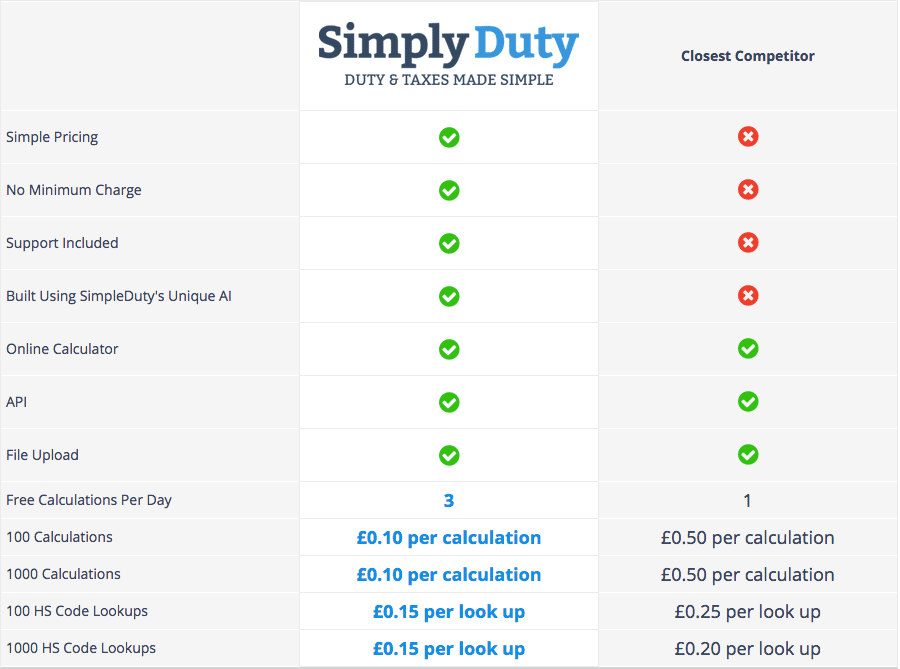

Amt Alternative Minimum Tax Calculator Calculator Academy

Direct Conversion Of Syngas To Alpha Olefins Via Fischer Tropsch Synthesis Process Development And Comparative Techno Economic Environmental Analysis Sciencedirect

The Project Gutenberg Ebook Of Ecological Studies Of The Timber Wolf In Northeastern Minnesota By L David Mech

Tm217463d1 Ex99x2x014 Jpg

Hr 8rce Bk

Income Tax Course Certification Rs 848 Month Henry Harvin

Amt Calculator Alternative Minimum Tax

Asml Holding Nv Exhibit 99 1 Smaller Size Bigger Capability Is A Well Established Trend In The Chip Industry And Thanks To The Joint Efforts Of Our 39 000 People Working Together With Suppliers

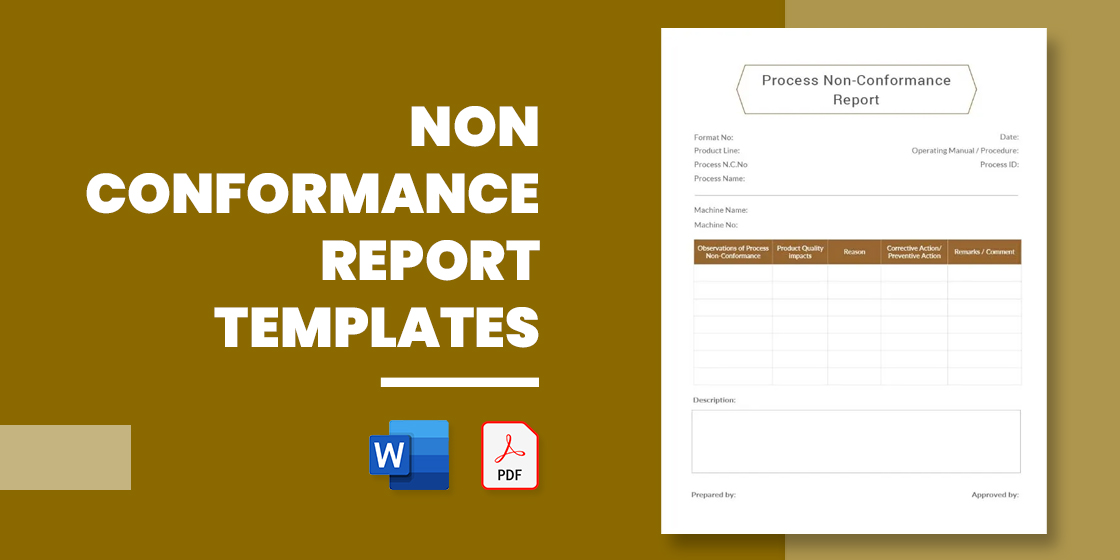

25 Non Conformance Report Templates Pdf Docs Word Pages